Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

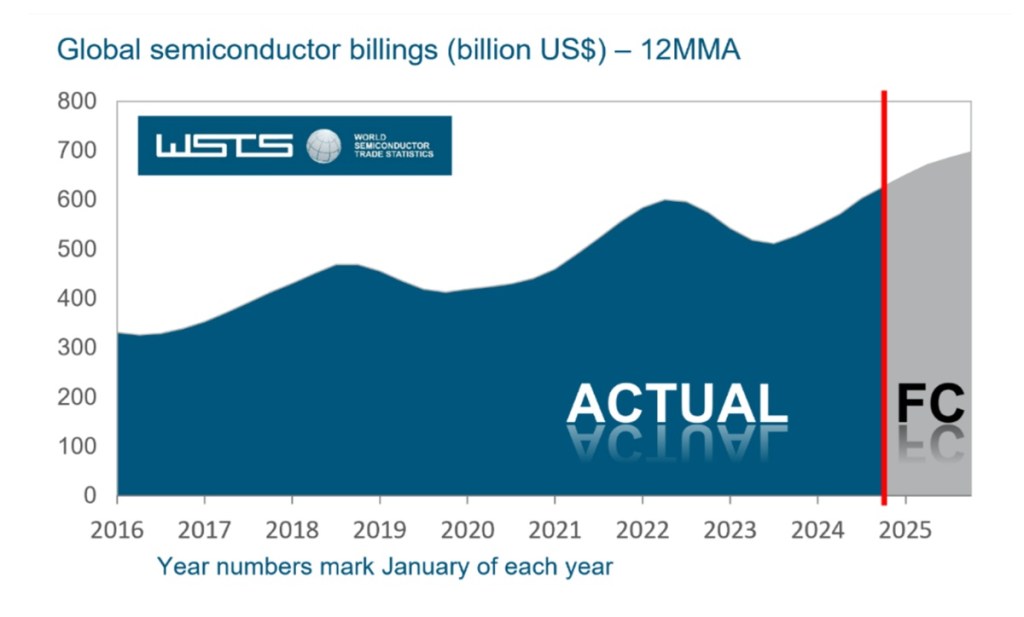

Global semiconductor chips sales increased 19.1% to $ 627.6 billion in 2024 and growth is expected to increase two -digit percentages in 2025, according to a report by the report Semiconductor Industry Association (IS).

The SIA said that the 2024 numbers reached a new record and compared with the total 2023 of $ 526.8 billion. The reason, of course, was the spectacular demand for processors and AI memory, said John Neuffer, CEO of the SIA, the lobbying group of the chips industry, in an interview with Gamesbeat.

The real growth of 19.1% was above the 13% prognosis made by the SIA, and the growth of 2024 compares with a contraction of 8.2% in 2023. That is a great swing in demand thanks to AI. And it is a reason why Nvidia is one of the most valuable companies in the world with an assessment of $ 3.15 billion.

And in 2025, Chip sales are expected to reach 11.2%growth, said Greg Larocca, director of market research and economic policy at the SIA, in an interview. This is important for the economy, since chips are the heart of everything electronic and are a vital part of the technological food chain.

The data arrive at an important moment in the national discourse, since President Donald Trump has committed to place tariffs on the semiconductor chips that come not only from China but also of our Taiwan ally. While taking measures against Mexico, China and Canada last weekend, tariffs were not yet imposed on Taiwan or French fries. (The tariffs of Mexico and Canada were delayed 30 days).

Jensen Huang, CEO of Nvidia, visited Trump last Friday at the White House to emphasize the importance of the semiconductor industry and US leadership at AI. Nvidia gets her Taiwan chips. The consumer technology association estimates that rates could make games consoles 40% more expensive for US consumers, with a price increase of 26% for smartphones and a 46% increase in laptops .

The SIA has also been a great defender of the Chips & Science law, a bipartisan law that allocated $ 52 billion for the reconstruction of the manufacture of chips in the US $ 2 billion for its US chips factories. UU. It remains to be seen if the new administration will continue to support the law, since defenders demand that more money be assigned.

“After all the plants that are in the process of construction and initiated and launched, at the end of all that, by 2032, the United States can increase around 14% or something. It takes time. It is an absolutely massive industry. And moving the needle from 10% to 14% is, in fact, a remarkably good number. It is a sign of how difficult it is to move. And it is the same for Europe, of course, “Duncan Stewart, chips leader in Deloitte, told me in an interview for a report this week.

As for chips numbers, sales of the fourth quarter of $ 170.9 billion were 17.1% more than the fourth quarter of 2023, and 3.0% more than the third quarter of 2024. And global sales for the month of December of 2024 were $ 57.0 billion, a 1.2% decrease compared to the total of November 2024.

Monthly sales are compiled by the World Organization for Semiconductor Commerce Statistics (WSTS) and represent a three -month mobile average. SIA represents 99% of the US semiconductor industry for income and almost two thirds of non -American chip companies.

“The global semiconductor market experienced its highest sales year in 2024, exceeding $ 600 billion in annual sales for the first time, and two -digit market growth is projected by 2025,” said Neuffer. “Semiconductors allow virtually all modern technologies, including medical devices, communications, defense applications, AI, advanced transport and innumerable others, and the perspective of the long -term industry is incredibly strongly strong.”

At the regional level, annual sales increased in the Americas (44.8%), China (18.3%) and Asia Pacific/all others (12.5%), but in Japan (-0.4%) and Europe (-8.1%). Sales from month to month in December increased in the Americas (3.2%), but decreased in Asia Pacific/all others (-1.4%), China (-3.8%), Japan (-4.7%) and Europe (- — 6.4%).

“As semiconductor sales increase worldwide, the United States will triple its national chip manufacturing capacity by 2032, putting our country in a solid position to reinforce their supply chains and help meet the growing global demand “Neuffer said. “To keep the United States on top of chips technology, leaders in Washington should advance policies that promote the production and innovation of semiconductors, strengthen high -tech workforce and restore US commercial leadership.”

Several semiconductor products segments stood out in 2024. Sales of logical products totaled $ 212.6 billion in 2024, which makes it the largest product category for sales. Memory products were the second in terms of sales, increasing by 78.9% in 2024 to a total of $ 165.1 billion. DRAM products, a memory subset, recorded an 82.6%sales increase, the highest percentage growth of any category of products in 2024.

Neuffer said logic (including processors), memory and analog segments are often on different trajectories, since there are many different types of semiconductors that serve all electronic industries. Logic and memory have been promoted by the demand for AI servers in data centers and PCs in offices and homes. But sometimes there is a good year for logic and a bad year for memory, depending on capacity.

Larocca said the SIA does not yet classify the AI chips separately, but much of AI technology is integrated into computer systems using logical chips. That category grew 81.% in 2024, he said.

“It is an amazing growth rate that we have never seen before,” said Neuffer. “It is really fast growth in all areas.”

But he pointed out that the industry can be “incredibly volatile” when it comes to oscillations in areas such as memory chips.

In euphemism, Neuffer said that the prospects for a commercial war are “problems.”

“Our supply chains depend deeply on global trade. The operation of these supply chains is everything to us. And on the other hand, something like three quarters of our clients are abroad. Therefore, global trade is just a large part of our success, ”said Neuffer.

Neuffer said he didn’t want to enter hypothetical about what is happening cold. He pointed out that the details are important, such as what happens with a chip that is sent from one place to another before it ends in an electronic product purchased in the US. UU. It also depends on which countries are affected with rates and retaliation.

In terms of educating politicians, he said that there is still a land to cover in terms of helping everyone to understand how supply chains work.

“We see measures that increase the cost of manufacturing in the US This administration as a priority for more manufacturing here, ”said Neuffer. “We really believe that there is an opportunity here to implement a kind of comprehensive strategy that includes a series of things, such as continuing with incentives that make the United States attractive to manufacturing, double some design incentives, implement a policy to recover our leadership Commercial worldwide since we depend on both global and industry trade. “

Neuffer said the Chips & Science law was incredibly important for the industry and fundamental for the country.

“But being alone is not a strategy. It is a piece of a larger strategy. And the biggest strategy has an immigration policy that ensures that the talent we train here remains here, and a broader workforce strategy to train talent here nationwide, ”he said.

Financing applied science and basic science is also critical in terms of keeping the United States competitive, he said. Some politicians have opposed to give money to corporations to build chip factories. But Neuffer said that other countries have used subsidies to get the manufacture of the USA. And now we are behind.

“That is why we conducted the trench in this, it is over the years. Our federal government was not in the game. Other governments around the world with Chip industries had been executing circles around us and were probably bewildered that we were trapped and, as a result, our manufacturing decreased dramatically in the last 30 years or so, ”he said. “The Chips Law has changed that and if in some way the incentives decrease again, this will also do our manufacturing footprint. That is just reality. “

Larocca said that the disparity in the incentives meant that it was 25% to 50% more expensive to build and operate a FAB in the US. In the absence of incentives of the United States compared to other countries. There are also reasons such as the resilience of the supply chain and national security to maintain the manufacture of chips on land, said Ne forfer. He pointed out that the incentives of the Chips and Sciences Law have generated almost $ 500 billion in investments in the US. Chips manufacturing capacity in the United States could triple. That is a higher growth rate than anywhere else in the world, said Neuffer.

Chips sales were interrupted during pandemia. While PC demand shot while people worked from home, factories were interrupted and the supply chain could not work during Covid. The industry had a decrease since the second half of 2022, and that led to a 8.2% drop in global sales in 2023, said the SIA. The growth of memory chips in 2024 reached 70% compared to 2023.

In general, the Chi industry moves in 18 -month economic cycles from excess supply to shortage. Part of the reason is that it costs billions of dollars and considerable time to build a new factory. As demand changes, it is difficult to generate more capacity quickly, and as a result, prices change.