Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

The number of active investors in the game will decline further as the sector remains underinvested relative to public market capitalization.

And venture capital-backed content developers will struggle to siphon market share from incumbents, according to a report from Pitchbook.

The number of active investors in game developers has fallen precipitously in the past year since the start of the COVID-19 pandemic, said Pitchbook, which tracks global venture capital investments. At the same time, another Pitchbook report noted that gaming communications platform Discord has a 93% chance of going public via an initial public offering (IPO) in 2025.

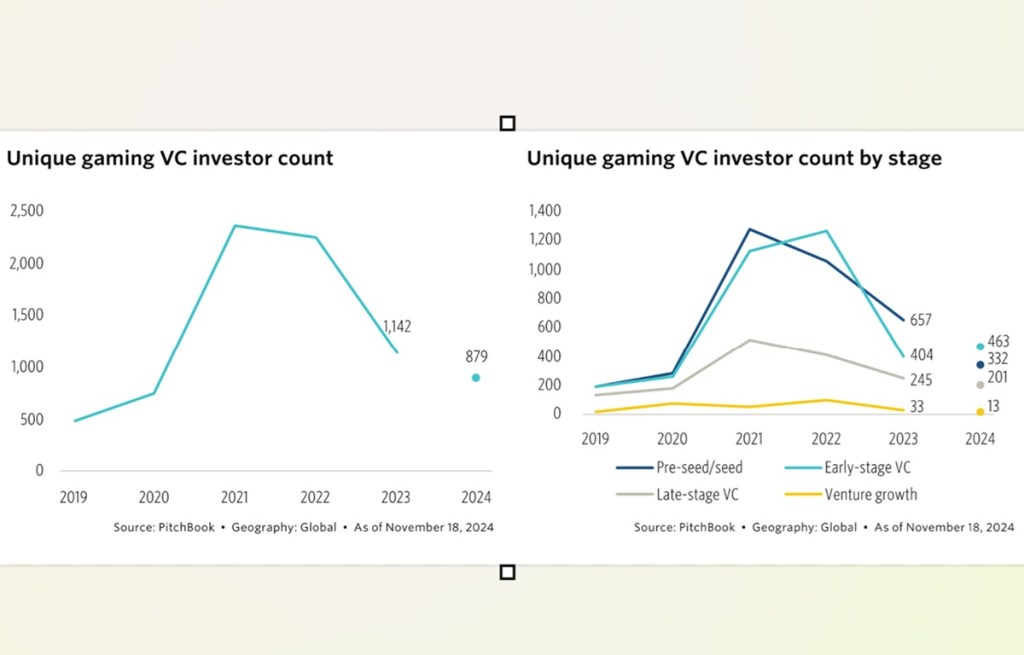

In 2021, the gaming boom arrived. Pitchbook said 2,359 venture investors wrote checks backing publishers, developers and studios (up from 734 in 2020). By 2023, the number has halved, to 1,142 investors, and by 2024 the pace is even lower.

“We expect more of the same in 2025, with a further decline in the number of investors backing content developers, but the long-term trajectory of the industry means the sector is not underinvested at $187.7 billion.” that are spent annually on games,” wrote Eric Bellomo. emerging technology analyst at Pitchbook.

The reasons for the abrupt inflows and outflows of capital are numerous. During the frenzy of the zero interest rate environment, record amounts of venture capital funds were started and record amounts of capital were raised across the venture ecosystem.

The games themselves were at the intersection of several emerging trends, which attracted unprecedented amounts of capital to the industry. Facebook had pivoted into the Metaverse, cryptocurrencies and blockchain-based gaming exploded into the zeitgeist, and gaming awareness increased as stay-at-home orders were issued, leaving consumers with little choice. entertainment options.

Unfortunately, what is easy comes and what is easy goes. By the end of 2023, the sector proved to be overinvested. A glut of previously delayed releases were in the hands of the public with a much weaker release slate scheduled for 2024. Interest rates soared, forcing investors to take a closer look at potential deals. Always time-consuming and expensive, game development cycles are unrecognizable compared to traditional software-as-a-service business models and soon became unpalatable.

Apple’s deprecation of IDFA (which prioritized user privacy over targeted ads) raised customer acquisition costs, further putting pressure on margins in mobile gaming. Exit avenues became difficult to see as mergers and acquisitions dried up, the IPO window closed and regulatory intervention in deals initiated by Meta (formerly Facebook) and Microsoft discouraged other buyers.

Faced with an abundance of content, consumers have increasingly opted to play established “forever titles,” leaving less and less time for net new releases.15 Finally, explosive interest in AI and machine learning has diverted dollars of categories that were previously fashionable.

However, Pitchbook maintains that the sector is underinvested. The market capitalization of the gaming industry exceeds $1 trillion globally (excluding Microsoft, but including Tencent),16,17 with only $1.5-$4 billion invested annually (excluding atypical COVID-19 years). 19), according to the Third Quarter 2024 Gaming Report.

This marks an infinitely small portion of the industry’s market capitalization being reinvested in high-risk companies. By comparison, public fintech companies have a market capitalization of more than $1 trillion,18 and between $10 billion and $17 billion are invested in the industry annually, according to the Pitchbook Q2 2024 Retail Fintech report. Report.

Similarly, the combined healthcare IT public market capitalization exceeds $100 billion with approximately $5 billion invested per year, according to our Q2 2024 Healthcare IT VC Update.

As such, new funds and crops have emerged since pioneers like London Venture Partners began targeting the ecosystem. Andreessen Horowitz committed $600 million to gaming as part of a broader $7.2 billion fundraising in April, Bitkraft announced a $275 million round for its third fund, and Griffin Gaming Partners announced its third flagship fund. Another group of specialist investors have also come online in the last four to six years to support the sector, including Makers Fund, Konvoy Ventures, 1Up Ventures, F4 Fund, Play Ventures and many others.

Despite the depressed quarterly investment numbers, there are several key tailwinds. The next generation of consumers spend large amounts of time in gaming environments.

More than 90% of consumers between 13 and 17 years old play every week, with an average of seven hours of play per week. The value of gaming has been established in technology companies (NVIDIA), movies (“The Super Mario Bros. Movie” and “Detective Pikachu”), television (“The Last of Us”) and more.

Across sectors, from e-commerce (Temu and SHEIN), to educational technology (Duolingo), media (The New York Times and Netflix) and social networks (Twitch, LinkedIn), games and gamification models have been prominently integrated into company retention. strategies. Emerging markets in Latin America, India and parts of Africa are also capable of attracting another billion consumers into this category within the decade.

These fundamentals will continue to attract more investors to the segment and additional tailwinds are expected with the launch of Grand Theft Auto VI and the new generations of consoles from Sony and Nintendo.