Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

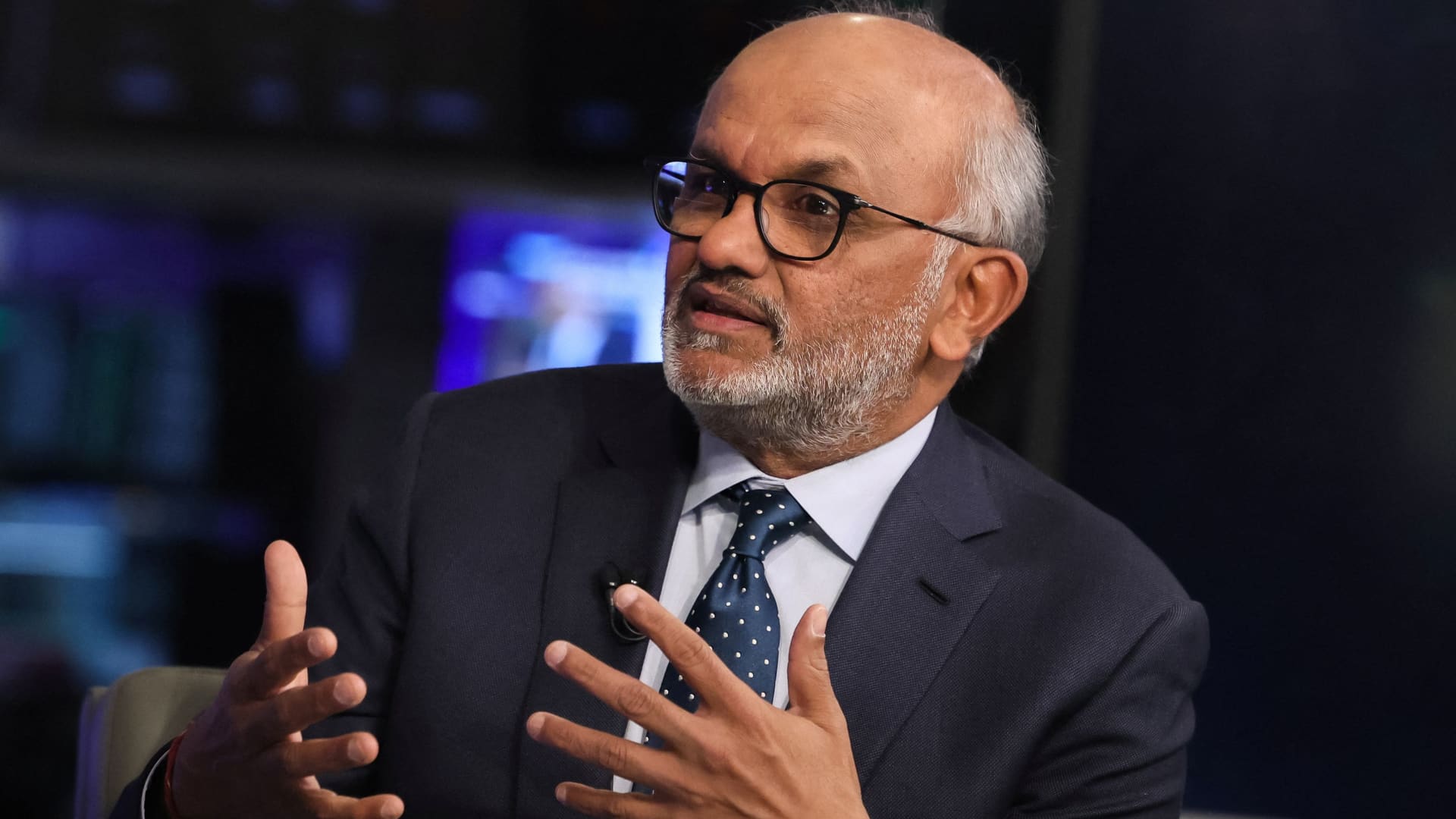

Adobe CEO Shantanu Narayen speaks during an interview with CNBC at the New York Stock Exchange on February 20, 2024.

Brendan Mcdermid | Reuters

Adobe Shares fell 13% on Thursday and were headed for their steepest decline since March after the software provider issued disappointing revenue guidance.

Sales in the fiscal first quarter will be between $5.63 billion and $5.68 billion, Adobe said in its fourth quarter. earnings report on Wednesday night. According to LSEG, analysts on average expected revenue of $5.73 billion.

Analysts at TD Cowen downgraded the stock to hold from buy, while Wells Fargo maintained its buy rating after what they called a “frustrating 24” for the company. The stock is now down 20% year to date, far behind the Nasdaq, which is up 33% and crossed the 20,000 mark for the first time on Wednesday.

While Adobe’s forecast came in below estimates, the company’s fourth-quarter results beat expectations.

Adjusted earnings per share were $4.81, beating analysts’ average estimate of $4.66, according to LSEG. Revenue in the fourth quarter rose 11% to $5.61 billion, beating the average estimate of $5.54 billion.

Monetizing generative AI, especially in standalone offerings like Firefly imaging or additional offerings in Creative Cloud, has been critical to Adobe’s growth strategy.

Analysts at Deutsche Bank maintained their buy rating but lowered their price target from $650 to $600.

“These results and guidance require some faith in the year ahead,” the analysts wrote. Still, they said, “We see tangible evidence that Adobe is one of the few application software companies in our coverage that is successfully monetizing generative AI today.”