Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

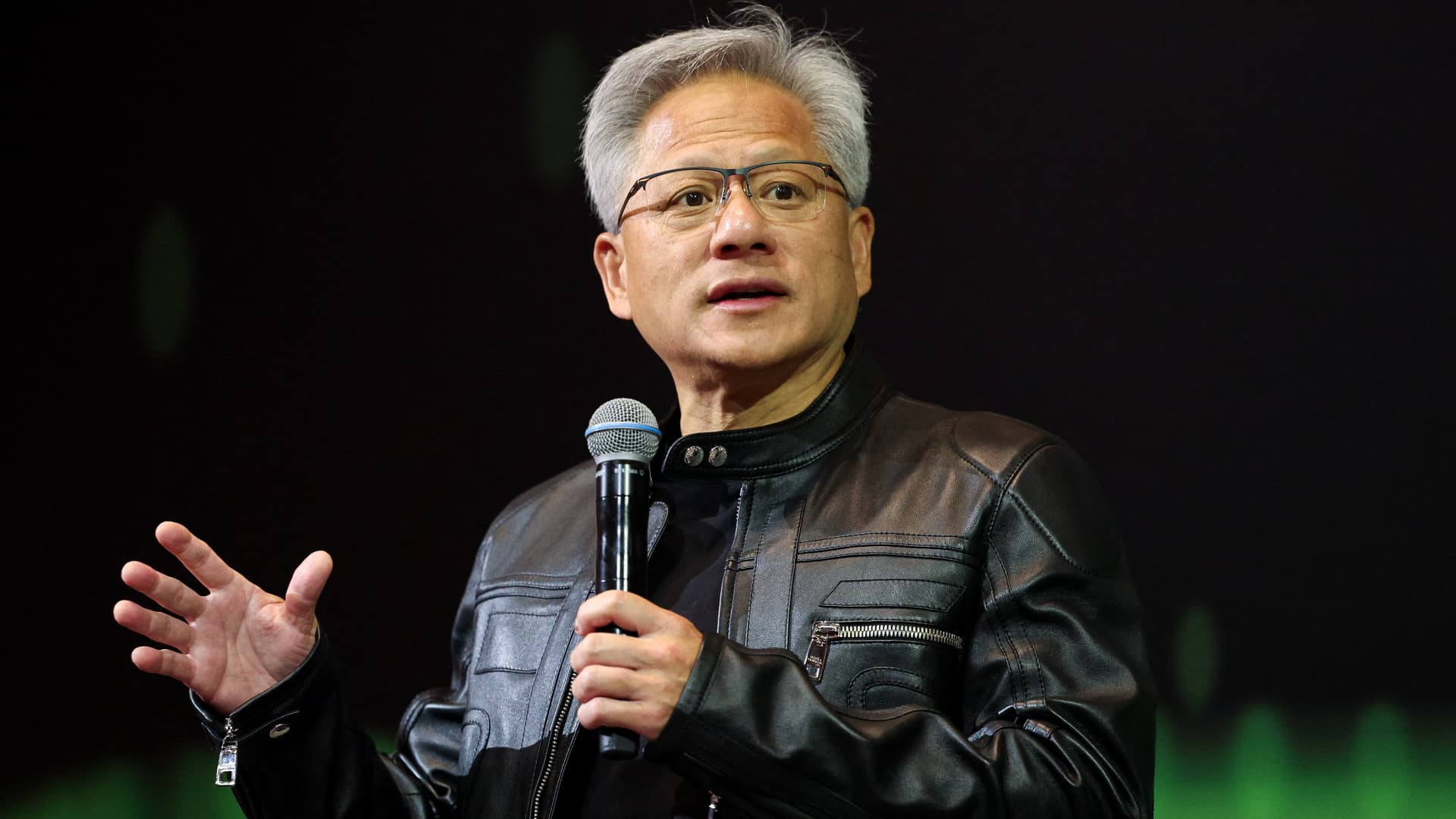

Jensen Huang, co-founder and CEO of Nvidia, speaks during a press conference about NVIDIA Earning in Taipei on May 21, 2025.

I-HWA Cheng | AFP | Getty images

Nvidia reported The profits and income better than expected on Wednesday, since the business of the company’s data center recorded a growth year after year of 73%.

The action increased approximately 4% in the extended trade.

This is how the company did, compared to the estimates of the analysts surveyed by LSE:

Nvidia said she expects around $ 45 billion in sales in the current quarter, versus LSE estimates of $ 45.9 billion of sales in the quarter of July. The company said its guide would have been approximately $ 8 billion higher, except for lost sales of a recent export restriction in its H20 chips bound for China.

During the quarter, the United States government informed NVIDIA that its previously approved H20 processor for China would require an export license. Nvidia said it incurred $ 4.5 billion in positions related to excess inventory for chip, and would have registered $ 2.5 billion in additional sales if the chip had not been restricted.

Nvidia said that her gross margin of 61% for the quarter would have been 71.3% if it were not for the position related to China.

Despite the political tension, the NVIDIA report shows that the company continues to grow aggressively, driven by the demand for its artificial intelligence chips, which are used to build and implement applications such as OpenAI chatpt.

“The global demand for NVIDIA’s infrastructure is incredibly strong,” said the CEO of Nvidia, Jensen Huang, in a statement.

Net income increased 26% also $ 18.8 billion, or 76 cents per share, of $ 14.9 billion, or 60 cents per share, a year earlier.

Income increased 69% in the quarter of $ 26 billion the previous year. Sales in the company’s data centers division, which includes AI chips and related parts, grew 73% annually to $ 39.1 billion, which represents 88% of total income.

Nvidia said that the large cloud suppliers constituted just under half of the income of the data center, and that $ 5 billion in sales were for the company’s network products, which are used to connect dozens of Nvidia chips for AI investigation.

The company’s games division, which includes its chips to play 3D games, grew 42% annually to $ 3.8 billion. Nvidia mainly made game chips before her semiconductors became essential for AI. It still makes the processor in the heart of the new Nintendo Switch 2. But its game chips can also be used for AI applications.

The company’s automotive and robotic division reported a sales growth of 72% to $ 567 million. Nvidia attributed the rise to additional sales of its chips and software for self -employed cars. The company’s professional visualization business, which is composed of chips for 3D design, as well as the DGX Spark and DGX Station desks of the company, grew 19% to $ 509 million in revenues during the quarter.

Nvidia said she spent $ 14.1 billion in shares of shares during the quarter and paid $ 244 million in dividends.

NVIDIA executives will organize a conference call with analysts to discuss the results at 5 PM ET.

These are last -minute news. Consult the updates again.

source link