Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

Useful information

Prime News delivers timely, accurate news and insights on global events, politics, business, and technology

Variable rental markets worked well in January, as they often do, but as dust is established in that execution of the early year, the long -term investors strategy remains the same: invest in companies that can Performing for long periods, either or did not move together with the market in January. A month of strong (or poor) yields means little in the great scheme of things.

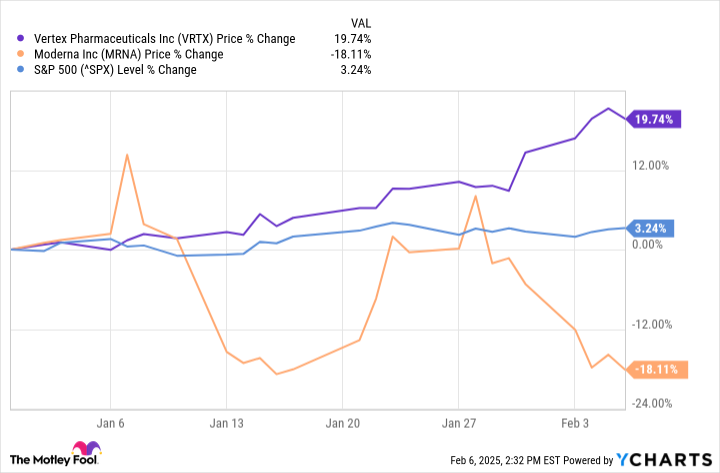

To illustrate that point, let’s discuss two actions in the biotechnology industry that have moved in opposite directions so far this year: Pharmaceutical vertices (Nasdaq: VRTX) and Modern (Nasdaq: RNM). Here are why these two companies could produce huge yields to patient investors.

VERTEX Pharmaceuticals is starting the strong year. On January 30, the company announced That the US Food and Medicines Administration had approved Journavx, the first non -oral pain signal inhibitor in gaining regulators’ green light. Verex’s actions jumped into the news and with a good reason. Taking into account the devastation that opioids have caused in many communities in the US, a pain treatment that avoids possible side effects of opioids satisfies a significant need.

In addition, the vertex now has medications approved between pain, falciform cell disease (SCD), beta-dot-dependent of transfusion (TDT) and, of course, cystic fibrosis (CF), its area of central experience . VERTEX still generates most of its income from its CF franchise and still offers excellent financial results. In the third quarter, the company’s revenues increased 12% year after year to $ 2.77 billion.

In the next two years, sales of the newest vertex medications, including Journavx, their next -generation CF therapy Alyftrek and Casgevy, which is treated by SCD and TDT, should increase significantly and help improve their already strong sales growth. In addition, the vertex will probably also make a lot of clinical progress. The company’s late stage pipe includes inaxoplin, a possible therapy for APOL-1 and Povetacicept renal disease, a research therapy for IgA nephropathy (a chronic renal disease).

There are no approved treatments that are directed to the underlying causes of both conditions. VERTEX Pharmaceuticals has more candidates in initial stage studies. There is still a lot of sales to seex pharmaceuticals, which makes it an upper part Biotechnology stock Buy this month and endure for a while.

Modern is a victim of his own success. Biotechnology was quite unknown in 2019, but it jumped to fame in 2020 when it successfully developed a vaccine for COVID-19, a project in which most of the other companies of any size failed. Modern made a small fortune thanks to this achievement, but its financial results and the price of the shares have moved in the wrong direction for most of the three years as the pandemic retreated. Even so, there are good reasons to expect the company to deliver strong long -term yields.